U.S. mid-cap stocks are flourishing in the shadows

Mid-cap stocks, those companies with market capitalizations between $1 billion and $20 billion, offer investors several advantages over their large and small counterparts, including superior long-term performance, higher risk-adjusted return, a compelling combination of attractive earnings growth and reasonable valuations, and access to companies at the peak of their growth cycle.

Despite these features, though, mid caps remain an underused market segment. Many investors are underweight in mid caps, mistakenly believing they're getting exposure to such stocks through investments in small- and large-cap strategies. Mid-cap stocks make up approximately 18% of the market capitalization of the U.S. equity market (as represented by the Russell 3000 Index), but investors are significantly underweight in the group, with only 14% exposure.1 Part of the reason for this underexposure could be a lack of active or passive mid-cap strategies, whether due to the closing of popular options or the availability of suitable alternatives.

There's also potentially less risk inherent with mid-cap companies, as they're typically small-cap companies that have succeeded and moved up the cap spectrum. Because they've survived the small-cap phase, mid caps may be in a position to benefit from enhanced access to the capital markets, potentially giving them a financial advantage over small caps. Also, when compared with large-cap companies, mid caps are often in the prime growth phase of the business lifecycle, where they may be experiencing higher cash flow, revenue, and earnings growth rates.

Long-term performance is the great equalizer

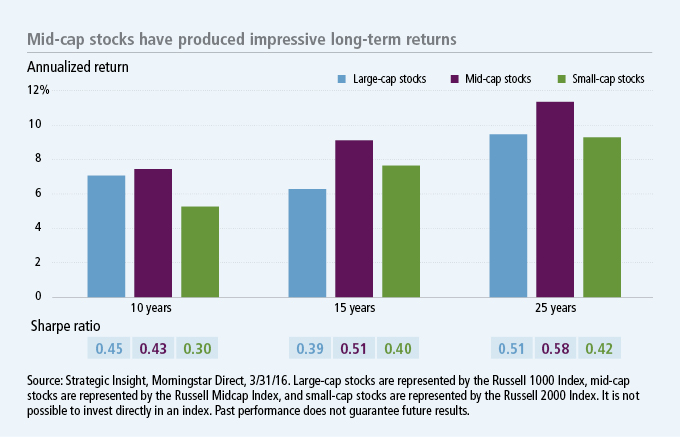

While investors might perceive that small caps historically outperform both large caps and mid caps, the Russell Midcap Index has outpaced both the Russell 1000 Index (large cap) and the Russell 2000 Index (small cap) in the most recent 10-, 15-, and 25-year periods.2 Of note, the 25-year time range incorporates various market cycles, including three major bear market declines (1987, 2000–2002, and 2008) and four significant bull market rallies (1982–1987, the 1990s, 2003–2007, and 2009–2016).

Not only have mid-cap stocks generated higher returns relative to large- and small-cap stocks over this time period, they've also provided superior long-term risk-adjusted returns, as measured by the Sharpe ratio, over most periods.

Action speaks louder than words

Mid caps aren't as widely followed by sell-side research analysts as their large-cap counterparts. The largest companies in the S&P 500 Index, on average, attracted nearly twice the number of analysts as the 10 largest companies in the S&P MidCap 400 Index, and the trading volume of the largest companies in both indexes reveals a decided tilt toward large-cap stocks.2

A frequently cited explanation of the market's relative underweight in mid-cap stocks is the scarcity of active fund managers due to capacity or efficacy reasons. We see the use of strategic beta3 strategies as a potential alternative for investors, as these approaches leverage the goals of active management by isolating certain factors that have the potential to generate superior long-term risk-adjusted returns.

We believe that mid caps present a compelling investment case and that they deserve to play a more significant role in investors' portfolios. Their position in the stable growth phase of a business' lifecycle, along with historical outperformance and favorable risk attributes, provides strong evidence that mid-cap stocks merit a more substantial position in a U.S. equity portfolio.

1 Strategic Insight, Morningstar Direct, 3/31/16. 2 Morningstar Direct, 3/31/16. 3 Strategic beta—along with multifactor investing, smart beta, fundamental indexing, and a few other related expressions—broadly refers to a diverse and growing category of rules-based approaches to investing in various markets.

Important disclosures

Important disclosures

The Russell Midcap Index tracks the performance of approximately 800 publicly traded mid-cap companies in the United States. The Russell 1000 Index tracks the performance of 1,000 of the largest publicly traded companies in the United States. The Russell 2000 Index tracks the performance of 2,000 publicly traded small-cap companies in the United States. The S&P 500 Index tracks the performance of 500 of the largest publicly traded companies in the United States. The S&P MidCap 400 Index tracks the performance of 400 mid-cap publicly traded companiees in the United States. It is not possible to invest directly in an index. Past performance does not guarantee future results.

The stock prices of midsize and small companies can change more frequently and dramatically than those of large companies, and value stocks may decline in price. Mid-cap companies are generally less established and their stocks may be more volatile and less liquid than the securities of larger companies. The prices of mid-cap company stocks are generally more volatile than large company stocks. They often involve higher risks because mid-cap companies may lack the management expertise, financial resources, product diversification, and competitive strengths to endure the adverse economic conditions.

MF301583