The long-term case for tech stocks remains robust

Investors in information technology have enjoyed big gains recently.

Tech stocks posted a 12-month total return of nearly 30%,1 buoyed by a handful of mega-cap companies with what one writer described as “great business models and unchallenged leadership in their markets.”2 The run-up has left some observers questioning the sustainability of current valuations, but the long-term case for certain technology stocks remains intact, in our view—especially for sector specialists with the ability to take long and short positions.

The technology sector is increasingly complex: Supply chains are becoming more global and the pace of innovation and disruption is accelerating. Across the sector, cyclical and secular changes combine to produce widely varied outcomes in operating performance between companies. As a result, we see a constantly evolving set of winners and losers—a fertile environment for active managers to find good long and short ideas.

Three transformational trends driving prospects for tech stocks

Technology has permeated our daily lives in ways that few of us could have ever imagined. Around the globe, billions of people are using smartphones to book travel, pay for groceries, monitor their fitness, and stay connected to friends. Issuers of tech stocks are finding new ways to engage with customers, run their businesses more efficiently, and identify incremental sources of revenue. For the past two decades, there's been a build-out of technology infrastructure that's laid the foundation for several long-term transformational trends that we believe deserve representation in investors’ portfolios.

Digital payments

The intersection of mobility and e-commerce is driving innovation in the payments industry. Smartphones are replacing wallets, and transactions previously conducted only in cash—for parking meters, vending machines, laundry machines, peer-to-peer payments—are being processed electronically. It's estimated that roughly $17 trillion in global transactions are still conducted using cash and checks,3 and that the growth rate of digital commerce—online and mobile—is five times the growth rate of physical transactions.4 The goal is to eliminate the need for hard currency and make the transfer of money faster, more convenient, and more secure. These innovations are made possible by a complex ecosystem of processors, gateways, banks, networks, and hardware and software providers. In all likelihood, we’re still in the very early stages of this global development.

Cloud computing

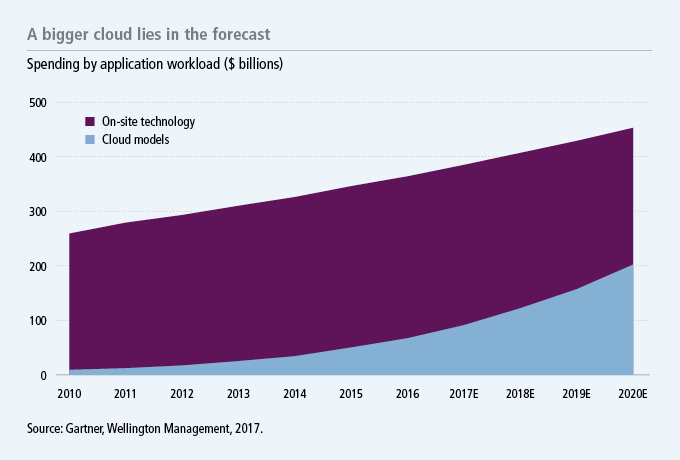

Historically, most companies managed their own information technology (IT) infrastructure, including servers, data storage, networking, and software. Cloud computing enables the delivery of IT services over the internet, reducing costs by eliminating the need for customers to operate expensive data centers and purchase their own on-site hardware and software. Cloud computing services can be provisioned quickly from a number of large, well-respected technology companies. The services can be scaled as needed, and they're typically run using the fastest and most efficient computing hardware.

The result is a network that's flexible and potentially cheaper, more efficient, and more secure. Enterprise migration to the cloud remains in the early stages, with less than 20% of total workloads currently being performed in the cloud; we expect this figure to be as high as 45% by 2020.5

Internet of Things

The Internet of Things (IoT) refers to the concept of everyday devices—automobiles, utility meters, thermostats, home appliances—communicating over the internet. So-called old tech devices are now being equipped with new electronics and component technology, which allows them to communicate with each other and with consumers. By 2021, global IoT spending is expected to reach $1.4 trillion, with near-term investment to be driven by use cases such as manufacturing operations, freight monitoring, and smart grid deployments.6 In the early years, much of that spending will be on the semiconductors and modules that enable end points to connect to the network, and on the software that runs the applications.

Several transformational trends underpin our long-term enthusiasm for tech stocks, including digital payments, artificial intelligence and machine learning, cloud computing, and IoT. This can create a fertile environment for active long/short managers to identify opportunities to pursue incremental returns. We believe that managers with extensive industry expertise, deep resources, and a global footprint will be in the best position to identify tech stocks of companies likely—and unlikely—to change our daily lives.

1 S&P 500 Sec/Tech, Morningstar, 8/1/17. 2 Memo to Oaktree Clients, Howard Marks, 7/26/17. 3 Visa, 2017. 4 eMarketer PRO, 6/13/17. 5 Gartner, Wellington Management, 2017. 6 IDC, 2017.

Important disclosures

Investing involves risks, including the potential loss of principal. A portfolio concentrated in one sector or that holds a limited number of securities may fluctuate more than a diversified portfolio. Past performance does not guarantee future results.

MF392421