How small cap stocks may benefit from the new tax law

After much uncertainty and anticipation, tax reform is here. While several aspects of the GOP’s overhaul of the tax code appear likely to benefit businesses across the market cap spectrum, the drop in the corporate tax rate from 35% to 21% is most important for smaller, domestically focused companies. Investors looking for opportunities created by tax reform would do well to focus on small-cap U.S. stocks.

A double-digit earnings boost

Tax reform will enable the repatriation of offshore earnings—allowing American businesses to reinvest hundreds of billions of dollars in U.S. assets. This will be a significant benefit to large companies, which derive as much as a third to 50% of their revenues from outside the United States. But more significant than a tax repatriation holiday, lower tax rates will represent a permanent benefit for small companies, which tend to have a domestic focus and, therefore, have higher effective tax rates than large companies.

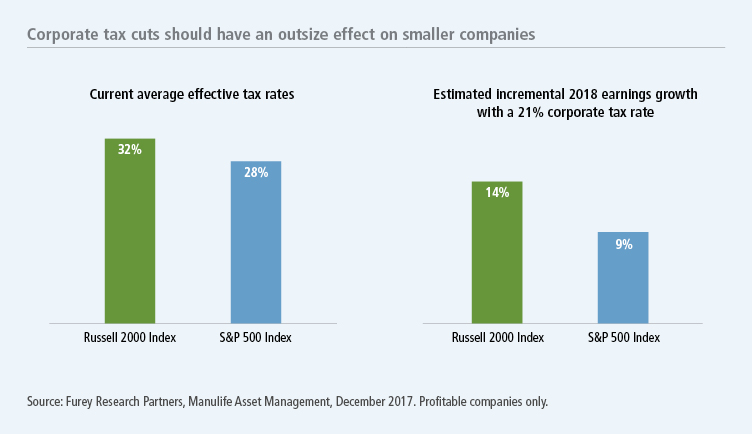

While effective tax rates vary by sector, the average company in the S&P 500 Index has until recently had an effective tax rate of 28%, whereas the average company in the small-cap-focused Russell 2000 Index has had an effective tax rate of 32%. All else equal, a corporate tax rate reduction to 21% should boost 2018 earnings for companies in the Russell 2000 Index by 14%, compared with approximately 9% for companies in the S&P 500 Index.

Given today’s elevated price-to-earnings multiples, earnings growth is the most important factor driving continued investor enthusiasm at this stage of the market cycle. With tax reform likely to prove an important near-term catalyst for earnings, we believe the relative value of domestic equities—and small caps in particular—is likely to improve.

Expect small companies to enhance capital allocation plans

With a tax-related windfall suddenly a reality, market observers are trying to anticipate what small-cap companies are likely to do with their enhanced cash flow. In our view, it seems unlikely that small companies would spend the tax savings on capital investments or acquisitions. Capital has been plentiful in recent years, so most company management has already made or initiated these types of actions.

We think it's more likely that the tax savings will be applied to capital allocation: debt reduction, share buybacks, and dividends. Leveraged small-cap companies will favor debt reduction, as the tax bill limits a company’s deduction for net interest expense to 30% of adjusted taxable income (ATI), a proxy for earnings before interest, taxes, depreciation, and amortization (EBITDA).

Higher-quality small caps have the greatest potential

Considering the likely effects of tax reform on small-cap value versus small-cap growth, we think the impact will be relatively equal. And yet, while small caps as an asset class are likely to benefit from tax reform across the board, we think those companies that are positively positioned from an earnings perspective stand to realize the largest actual benefits and will have the luxury of making the most meaningful adjustments to their capital allocation plans.

In other words, quality will matter. In our research, we favor higher-quality companies that have proven their ability to generate profits or that we believe are about to do so. In this regard, we favor companies that we expect will realize 100% of the impact of lower tax rates. It’s worth mentioning that more speculative growth companies that aren't profitable generally don’t have a tax bill, so lower tax rates can't represent a real catalyst for their earnings.

An economic sweet spot

While higher inflation and interest rates bode well for equities generally, periods of improving GDP and the early phases of rising interest-rate cycles have historically been positive relative environments for small caps. Coupled with tax reform—a singular event for domestically focused companies given the magnitude of the tax rate change—we think positive cyclical conditions will continue to provide attractive small-cap opportunities.

Now approaching its tenth year, many may feel the current bull market is entering uncharted waters, but in our view, the tide continues to rise for equities. Ultimately, we believe tax reform will be a more important earnings catalyst for higher-quality small-cap companies than virtually any other market segment. With an eye on idiosyncratic opportunities in this space, we believe the environment for small caps has rarely been more compelling.

Learn more about investing in U.S. equities here.

Important disclosures

The Russell 2000 Index is an unmanaged index composed of 2,000 U.S. small capitalization stocks. The S&P 500 Index is an unmanaged index that includes 500 widely traded common stocks. It is not possible to invest directly in an index.

The stock prices of midsize and small companies can change more frequently and dramatically than those of large companies.

MF425576