Equity valuations: fair, but the market is stocked with active opportunity

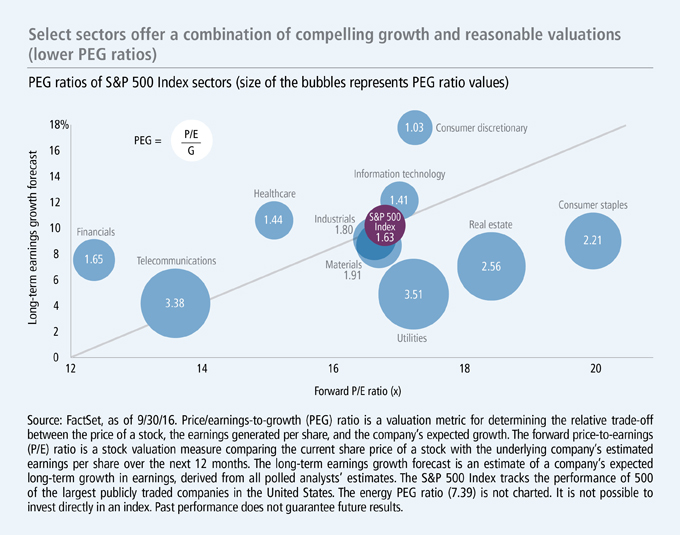

Looking at the S&P 500 Index from an absolute P/E ratio perspective, it's trading near its long-term average of around 17 times forward earnings; however, we're currently finding a tremendous amount of opportunity in equity valuations through our active investment process.

We're focused on individual bottom-up stock selection, not the overall market

We believe the key differences between this market environment and that of 2007/2008 is the strength of the U.S. consumer, the housing market, and America's largest banks, which are sporting their strongest balance sheets in decades, as well as the energy sector, which has been operating in a lower oil price environment. On the flip side, equity valuations that look more expensive include the utilities and telecommunication services sectors, which are trading near 15-year high relative multiples, as investors have dangerously treated these limited growers as bond-like income instruments.

This is how you should invest your last dollar

If you had only one investment you could make with your last dollar, the e-commerce industry is a very solid and clear investment opportunity. Less than 10% of the total $4.5 trillion U.S. retail sales are transacted online, and we think that because of the convenience, a widening selection, and lower prices, e-commerce is likely to double over the coming decade in terms of penetration of retail sales.1 The overall cloud businesses—whether they're companies providing storage, outsourced software, or enterprise resource planning implementations—will benefit because the overall e-commerce industry will need increased computing power over the coming decade to provide good service to the customer. The dominant cloud providers are very well positioned, but we believe Amazon.com stands out as probably the biggest beneficiary of this e-commerce trend going forward.

Large-cap financials continue to be attractive

Large-cap financials are trading at a 30% price-to-book value discount versus where they historically trade relative to the market, and we believe they'll benefit from rising rates, improved balance sheets, and decent credit growth.2 Financials are also trading at a relatively low PEG (P/E-to-growth) ratio, which means investors are paying less for earnings growth potential. The current stock prices of the large-cap banks are basically baking in no interest-rate improvement at all for the next five years. Our assumptions are for no increase this year or next year, followed by a modest pickup in interest margins by years three, four, and five. The banks have passed the U.S. Federal Reserve stress tests with flying colors and are stronger than they've been in the last 30 to 40 years, but they're currently priced as if they're going out of business.

What to do now: stay active and consider buying U.S. equities

We think there's a place for active investors with long-term records of following a disciplined investment process that generates repeatable and consistent performance. If an active investment manager has a track record of delivering alpha over the long term—one, three, five, or ten years—we do think that active has a place. We don't believe a U.S. recession is on the near-term horizon, and we're optimistic about the opportunities that quality U.S. equities trading at attractive valuations currently offer investors.

1 U.S. Census Bureau, as of 9/30/16. 2 S&P Dow Jones Indices, as of 9/30/16.

Important disclosures

Important disclosures

The S&P 500 Index tracks the performance of 500 of the largest publicly traded companies in the United States. It is not possible to invest directly in an index. Forward price-to-earnings (P/E) ratio is a stock valuation measure comparing the current share price of a stock with the underlying company's estimated earnings per share over the next 12 months. Price to book is the ratio of a stock's price to its book value per share.

Large company stocks could fall out of favor, and value stocks may decline in price. A portfolio concentrated in one sector or that holds a limited number of securities may fluctuate more than a diversified portfolio.

MF326069