What older investors can learn from millennials

A common media story line is that the 2008 financial crisis and accompanying recession made for a jarring introduction to the world of investing for millennials, just as they entered their working years and gained the capacity to save for the future. Fearful of the next crisis, the story goes, millennials now avoid equities, defying the conventional wisdom that they should maintain a near 100% equity allocation in their portfolios to maximize their savings potential for retirement decades in the future.

To the extent that this depiction is true, broad underexposure to equities among millennials could introduce a new dimension to the nation's retirement savings deficit. A multitude of millennials could enter middle age without adequate savings, then find themselves tempted to play catch-up by taking on an inordinate amount of risk in the final years before retirement.

While there are undoubtedly anecdotal examples of younger investors whose fear of equities may appear to be extreme, the story line doesn't necessarily ring true when viewed across abroad spectrum of millennial investors based on our analysis of asset allocation data from the portfolios of millennials invested in 401(k) plans provided by John Hancock Retirement Plan Services (JHRPS).

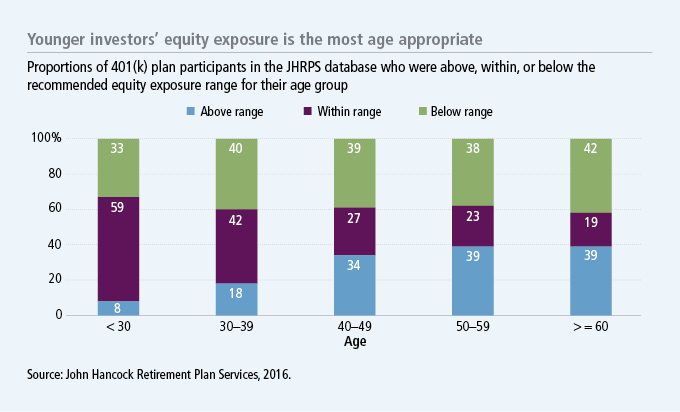

Investors in their 20s were the most likely to maintain equity exposure within the range recommended for their age group, based on asset allocation guidelines established by John Hancock Investment Management—guidelines that attempt to strike a balance between maximizing long-term earnings potential without incurring undue drawdown risks entering or during retirement.

Nearly 60% of participants younger than age 30 had within-range equity exposure based on data as of December 31, 2015, according to an analysis by JHRPS. The group with the next highest proportion of investors within the recommended range of equity exposure was the 30- to 39-year-old cohort (including the oldest millennials), at 42%. From there, the proportion of investors within recommended equity exposure ranges decreased for each successive group.

Across all age groups, 34% of investors were within the recommended equity exposure range for their age group; 28% were above the recommended range, and thus potentially overexposed to equities; and 38% were below that range, and potentially underexposed to equities. The fact that those 60 and older were the least likely to maintain equity exposure within the range recommended for their group suggests that older 401(k) participants could stand to learn a thing or two from millennials, at least when it comes to investing.

Connections between auto-enrollment, target-date funds, and optimal asset allocation

While a number of factors may be at work, it appears that, in aggregate, younger plan participants' asset allocation is benefiting more than their older counterparts' allocation from two related trends: growth of participant auto-enrollment into 401(k) plans and increased use of target-date funds as a qualified default investment alternative in the plans. Regardless of age, investors who maintained equity exposure within the range recommended for their age were more likely than those outside of that range to have been auto-enrolled into their plans rather than having opted into them, according to the participant data.

Across the age spectrum, younger workers were more likely to have been automatically enrolled when starting a new job than older plan participants; conversely, the older participants were more likely to have elected to opt in. Among those in the JHRPS participant database who were younger than 30 as of December 31, 2015, 77% were auto-enrolled, and 60% of 30- to 39-year-olds were auto-enrolled. On the opposite end of the age spectrum, just 38% of those 60 and older were auto-enrolled.

Auto-enrollment is correlated with a greater likelihood of age-appropriate equity exposure because auto-enrollees are more likely than non-auto-enrollees to have invested intarget-date funds, which adjust asset allocation as the investor approaches retirement based on parameters designed to balance risks and long-term return potential. Those who weren't auto-enrolled were less likely to be invested in target-date funds and, therefore, were more likely to have taken a less systematic approach to investing-one that wasn't necessarily aligned with recommended levels of equity exposure and was instead the product of each participant's perception of what constituted an appropriate asset allocation to fit personal needs.

The implications

While the JHRPS data casts doubt on the recent story line about millennials' aversion to equities and investment risk in general, the more important conclusion that we draw from these findings is that target-date funds are useful tools to help 401(k) participants and other investors stay on track toward reaching their long-term investing goals. Far too many investors are over- or underexposed to equities to the extent that they risk outliving their savings or sustaining an ill-timed drawdown entering retirement—a fact that many professional retirement plan advisors may wish to highlight to plan sponsors so they can consider additional steps to encourage participants to maintain age-appropriate equity exposure.

All data cited in this paper is from the 401(k) participant database of John Hancock Retirement Plan Services.

Important disclosures

Important disclosures

Diversification does not guarantee a profit or eliminate the risk of a loss.

A note on target date funds: The portfolio's performance depends on the advisor's skill in determining asset class allocations, the mix of underlying funds, and the performance of those underlying funds. The portfolio is subject to the same risks as the underlying funds and exchange-traded funds in which it invests: Stocks and bonds can decline due to adverse issuer, market, regulatory, or economic developments; foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability; the securities of small companies are subject to higher volatility than those of larger, more established companies; and high-yield bonds are subject to additional risks, such as increased risk of default. Each portfolio's name refers to the approximate retirement year of the investors for whom the portfolio's asset allocation strategy is designed. The portfolios with dates further off initially allocate more aggressively to stock funds. As a portfolio approaches and passes its target date, the allocation will gradually migrate to more conservative, fixed-income funds. The principal value of each portfolio is not guaranteed, and you could lose money at any time, including at, or after, the target date. Liquidity-the extent to which a security may be sold or a derivative position closed without negatively affecting its market value, if at all-may be impaired by reduced trading volume, heightened volatility, rising interest rates, and other market conditions. Hedging and other strategic transactions may increase volatility and result in losses if not successful. Please see the portfolio's prospectus for additional risks.

MF309045