How is Social Security changing in 2018

Social Security has provided a vital safety net for retirees for more than 80 years. Today, the program provides benefits to nearly 9 out of every 10 Americans age 65 or older, replacing roughly 40% of a retiree’s preretirement income on average.1 Social Security benefits include not only retirement payments for workers, but also benefits for their spouses and individuals with disabilities—making it an essential part of retirement and financial planning for many Americans. Here are the important changes for 2018.

Increased benefits

The Social Security Administration (SSA) announced in October that retirement benefits would be 2% higher in 2018 than in 2017, helping retirees’ payments keep pace with inflation. For example, if your 2017 benefit was $1,000 per month, your monthly payment will rise to $1,020 in 2018. The cost-of-living adjustment (COLA) is welcome news for many recipients, especially after an increase of just 0.3% in 2017 and no increase the previous year. The COLA is calculated once a year based on changes in the consumer price index. It can be 0% in a year, but it’s never negative, even when prices decline.

Full retirement age

The SSA pays benefits based on a formula that takes into account your age. The standard benefit is paid to people who have reached what the SSA calls full retirement age. In 2018, that age is 66, meaning if you turn 66 next year, you will be able to claim full Social Security benefits. For people born in 1960 or later, the SSA defines full retirement age as 67 in order to reflect longer lifespans.

There are two other options to consider before you elect to receive benefits, both of which alter the amount you will receive:

- If you turn age 62 in 2018, you can start taking benefits, but your monthly payment will be smaller—as much as 25% smaller than if you wait until your full retirement age.

- You can increase your monthly benefit by waiting until after full retirement age. Your payment will increase 8% each year after your full retirement age until you reach age 70 (after that there’s no benefit in waiting longer).

Fortunately, the SSA has a simple calculator to help estimate the size of your monthly benefit depending on when you retire.

Increased thresholds for earned income

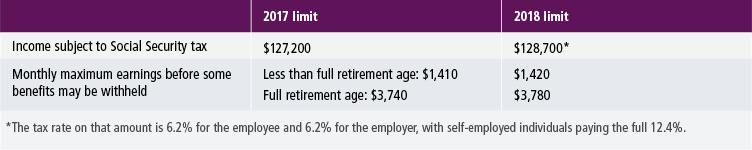

Most people pay into the Social Security system during their working years by paying a Social Security tax on their earnings. The tax is levied on earnings up to a specific amount of income each year, and the limit increases for 2018. Likewise, some benefits are withheld when retirees receiving Social Security earn more than a certain amount of income; that threshold increases as well, but the source of the earnings matters. See the table below for details.

Factoring Social Security into your financial plan

There are many different ways to think about Social Security in the context of your financial plan. For example, you may choose to work while receiving benefits—even if it results in smaller benefits now—in order to maximize the amount you’ll receive when you turn 70. A larger monthly benefit may help reduce the risk that you’ll outlive your savings, especially since the payment is adjusted for inflation.

You may also view your Social Security benefit as a stable and reliable income stream in a broader income-generating portfolio that includes financial assets. Viewed in this way, your Social Security benefit may empower you to feel more comfortable taking on greater risk with other financial assets, whether that’s pursuing growth or higher levels of income.

Consider this year-end planning season an opportunity to review your long-term Social Security strategy with your financial professional. Whether you’re starting your career, in your prime earning years, approaching retirement, or already retired, Social Security is likely to be a key component of your retirement plan, and your financial professional can help you make the most of it.