Next Fed Chair Powell: status quo candidate for a status quo economy

President Trump nominated Jerome H. “Jay” Powell as the next chair of the Board of Governors of the U.S. Federal Reserve System, the Fed. If confirmed by the Senate, Mr. Powell, a Fed governor since 2012, is set to succeed current Fed Chair Janet L. Yellen when her term ends on February 3, 2018.

Mr. Powell has a diverse private- and public-sector background and has not followed the traditional academic route to his new role. In fact, he’ll be the first Fed chair since G. William Miller (1978–1979) without a Ph.D. in economics.1 Prior roles before joining the Fed included partner at The Carlyle Group and assistant secretary and undersecretary of the U.S. Treasury under President George H.W. Bush.2

Powell is likely to continue the Fed’s current course for now

Consensus thinking suggests Mr. Powell will continue the Fed’s gradual path of interest-rate increases, which is probably correct; however, because of his varied path to the Fed, there is some uncertainty about how he might react if the economy were to look significantly different than it does today.

Whereas Dr. Yellen had published extensively on the labor market as an academic and therefore had laid her interests bare before she arrived at the Fed, Mr. Powell’s monetary policy priorities are not as prominently displayed on his sleeve.

Furthermore, Dr. Yellen’s tenure at the Fed was much longer and covered environments when inflation was both relatively high and low. Investors could therefore extrapolate from those experiences to predict how she might react if economic conditions were to change, for better or worse. This is not the case for Mr. Powell, given that his entire time at the Fed has been characterized by persistently low inflation.

Still, he has spoken publicly several times as a member of the Federal Open Market Committee, or FOMC, leaving retirement savers and other investors with a number of clues as we begin to work out his thinking in more detail. Here’s a cheat sheet of some of his key views.

U.S. economy: growth potential is about 2%

- Economic growth potential now is “about 2%,” Mr. Powell said during a speech at the Economic Club of New York in June 2017. “I expect that unemployment will decline a bit further and remain at low levels for some time, which could draw more workers into the workforce, put upward pressure on wages, or cause businesses to invest more as labor costs rise, all of which I would view as desirable outcomes.”3

- However, we are already “close to full employment,” and relatively low productivity continues to depress wages. Mr. Powell noted “average hourly earnings are rising only about 2.5% per year, slower than before the crisis, [and] much of that downshift may reflect the slowdown in productivity growth we have experienced.”3

- Inflation will move up to 2% as slack tightens, although the “relationship between slack and inflation has weakened substantially over the years.”4

Monetary policy: shrinking the balance sheet, up to a point

- The Fed is close to achieving its mandates of price stability and full employment. “Today, the economy is as close to our assigned goals as it has been for many years.”3

- It is appropriate to slowly normalize interest rates. “If the economy performs about as expected, I would view it as appropriate to continue to gradually raise rates.”3

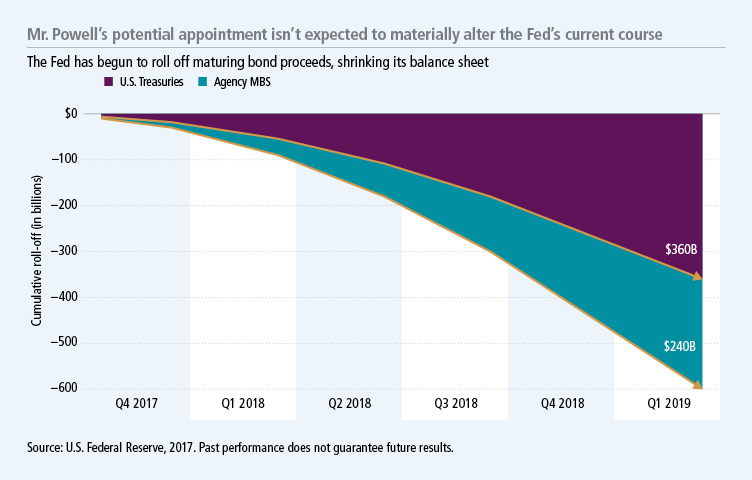

- Shrinking the Fed’s $4.5 trillion balance sheet should have a limited impact. “The shrinkage of the Fed’s balance sheet is also expected to proceed quite gradually,” he said in a speech last month.5 “It’s hard for me to see the balance sheet getting lower than $2.5 trillion … over the course of the next five years.”6

Regulation: tweak—rather than repeal—measures to reduce constraints

- Mr. Powell is widely viewed as being more lenient with regard to regulation, but he’s in favor of modifying key regulatory measures rather than repealing them altogether. “The market needs to believe—and it needs to be the case—that every private financial institution can fail and be resolved under our laws without imposing undue costs on society.”1

- There should be changes to the Volcker Rule for smaller firms with small trading books. “The burden of regulatory compliance can be particularly daunting for small banks.”1

- Capital and liquidity requirements are about right, but we may need more regulation of clearing houses and derivatives. “With inflation in check, the most important risk is that of financial instability.”1

What could investors expect under the Fed’s new leadership?

We have some idea from Mr. Powell’s speeches how he views current conditions in the United States. However, if we were to see a sharp spike in inflation, or if the economy went into a downturn, it’s less clear how he might be inclined to react. Mr. Powell voted in for the third round of quantitative easing (QE3) in 2012 even though he was not in favor of it, but the Fed may not have much room to cut rates the next time the United States goes into a recession—and QE may be the only dry powder left to deploy.

While Mr. Powell’s background in business and at the U.S. Treasury means investors have less of a sense of his thinking and priorities, this needn’t be considered a negative. A lot of the relationships we have relied on in economics are breaking down given that we now have an oversupply—rather than the traditional scarcity—of labor, capital, and goods. It could therefore be a real asset to have someone with an unconventional, nonacademic perspective leading the central bank to think about these economic relationships differently.

1 “Powell’s In Power,” BCA Research U.S. Investment Strategy Weekly Report, 11/6/17.

2 federalreserve.gov/aboutthefed/bios/board/powell.htm

3 federalreserve.gov/newsevents/speech/powell20170601a.htm

4 federalreserve.gov/newsevents/speech/powell20160628a.htm

5 federalreserve.gov/newsevents/speech/powell20171012a.htm

6 cnbc.com/2017/06/01/cnbc-exclusive-cnbc-transcript-federal-reserve-governor-jerome-powell-speaks-with-cnbcs-steve-liesman-on-squawk-on-the-street-today.html

Important disclosures

Important disclosures

Quantitative easing is a monetary policy in which a central bank purchases government debt or other assets in an effort to lower interest rates, increase the money supply, and stimulate economic growth.

Views are those of Megan E. Greene, chief economist, John Hancock Asset Management, and are subject to change. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, mutual fund, sector, or index.

Investing involves risks, including the potential loss of principal. The stock prices of midsize and small companies can change more frequently and dramatically than those of large companies. Growth stocks may be more susceptible to earnings disappointments, and value stocks may decline in price. Large company stocks could fall out of favor, and foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. Fixed-income investments are subject to interest-rate and credit risk; their value will normally decline as interest rates rise or if an issuer is unable or unwilling to make principal or interest payments. Investments in higher-yielding, lower-rated securities include a higher risk of default. Precious metal and commodity investments can be volatile and are affected by speculation, supply-and-demand dynamics, geopolitical stability, and other factors.

MF413805