What is absolute return investing

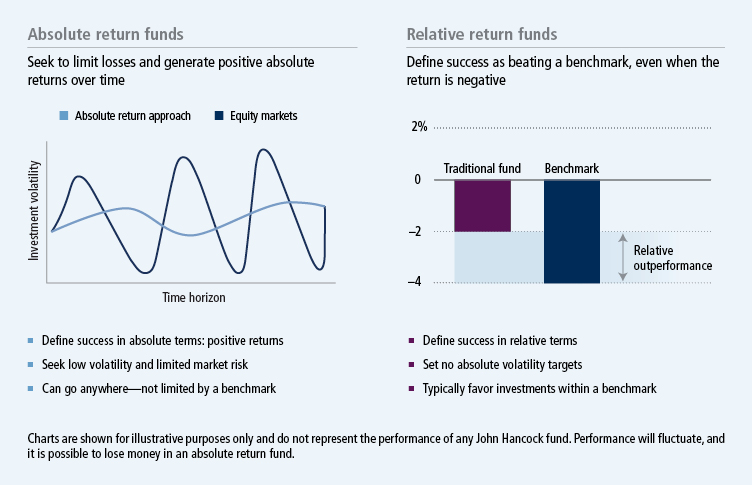

Absolute return investing describes a category of investment strategies and mutual funds that seek to earn a positive return over time—regardless of whether markets are going up, down, or sideways—and to do so with less volatility than stocks.

If you’re like many investors, you may be wondering what is so novel about that. Don’t all funds seek a positive return? The fact is, since the advent of performance benchmarks like the S&P 500 Index, most funds have defined success in relative terms. If a fund outperforms its benchmark, it’s considered a success, even if the fund’s return is negative. If a fund underperforms its benchmark, it’s considered a failure, even if that fund is meeting its stated objective. Relative return funds also rarely set absolute volatility targets, preferring again to compare their volatility against that of their benchmark indexes.

The benefits of being different

Absolute return funds take a different approach altogether. By doing away with conventional benchmarks and instead striving for consistently positive performance and lower levels of volatility, absolute return funds can offer a number of potential benefits when added to a broadly diversified portfolio:

· Reducing overall portfolio volatility

· Limiting losses in down markets

· Broadening the sources of investment returns

· Providing valuable diversification potential

· Improving a portfolio’s risk-adjusted return

One way to think about absolute return strategies is that they are the worriers of your portfolio. While other portfolio managers are thinking about what can go right in financial markets, absolute return managers are obsessed with what could go wrong, and manage risk accordingly.

How do they do it? Absolute return funds vary widely in the tools they use to implement their strategies. In fact, these funds are often referred to as unconstrained because they can invest in a vast array of financial instruments—stocks, bonds, currencies, derivatives, short positions—just about anything that may help deliver that positive return with less volatility.

What absolute return funds have in common is that they generally strive for returns that have a low correlation to traditional stock and bond markets. Correlation is a statistical measure that describes how investments move in relation to each other. If two assets have a correlation of 1.0, they are said to be perfectly correlated and will generally generate returns in the same direction, and to the same degree. If two assets have a correlation of –1.0, they are considered negatively correlated, meaning they perform in the exact opposite direction but to the same degree. A correlation of zero means the two assets have no performance relationship at all.

This lack of correlation can be helpful to a portfolio because there are times during market downturns when correlations rise among traditional asset categories such as stocks and bonds. In fact, during the 2008 sell-off, financial assets notoriously declined across a wide variety of asset categories around the world. The time-honored approach of mixing stocks and bonds in portfolio for diversification was simply not enough to prevent losses. Having a portion of a portfolio invested in absolute return strategies is one way of helping to limit losses—and potentially generating gains—when nothing else is going up.

The latest Market Intelligence is now available

Market Intelligence is designed for financial professionals, with charts highlighting market and economic themes that are top of mind for investors.

Measuring success in absolute return investing

Without traditional benchmarks as a guide, it’s not as simple to determine whether an absolute return fund is doing its job. Investors can also be disheartened during strong equity bull markets, when these relatively conservative strategies almost always trail their stock fund brethren. Fortunately, there are two commonplace metrics that together can shed light on absolute return performance.

Standard deviation measures the performance fluctuation or volatility of a financial asset or portfolio. An absolute return fund’s standard deviation should be significantly lower than that of any broad stock market index, 50% lower or less. All other things being equal, the addition of a low-volatility investment into a portfolio will reduce the overall portfolio volatility.

Sharpe ratio measures the incremental return achieved per unit of risk taken, as defined by standard deviation. A higher Sharpe ratio suggests better risk-adjusted performance.

The ultimate goal of adding an absolute return fund to a portfolio is to improve the risk-adjusted return of the entire portfolio, with a higher incremental return achieved from a less volatile mix of investments.

Important disclosures

1. Source: FactSet. Emerging markets are represented by the MSCI Emerging Markets Index, which tracks the performance of publicly traded large- and mid-cap emerging-market stocks. International small cap is represented by the MSCI Europe, Australasia, and Far East (EAFE) Small Cap Index, which tracks the performance of publicly traded small-cap stocks of companies in those regions. Total returns are calculated gross of foreign withholding tax on dividends. Global real estate is represented by the Dow Jones Wilshire Global REIT Index, a measure of the types of global real estate securities that represent the ownership and operation of commercial or residential real estate. Natural resources are represented by the MSCI Natural Resources Index, which features equity securities of companies engaged in the natural resources industry. International stocks are represented by the MSCI Europe, Australasia, and Far East (EAFE) Growth Index, which tracks the performance of publicly traded growth-oriented large- and mid-cap stocks of companies in those regions. Total returns are calculated gross of foreign withholding tax on dividends. U.S. real estate is represented by the FTSE NAREIT Equity REIT Index, an unmanaged index consisting of the most actively traded REITs. U.S. stocks are represented by the S&P 500 Index, which tracks the performance of 500 of the largest publicly traded companies in the United States. Bank loans are represented by the Bloomberg Barclays High Yield Municipal Bond Index, which tracks the performance of municipal bonds rated below investment grade (BBB/Baa) and those that are unrated. High-yield bonds are represented by the Bank of America Merrill Lynch (BofA ML) U.S. High Yield Master II Index, which tracks the performance of globally issued, U.S. dollar-denominated high-yield bonds. TIPS is represented by the Bloomberg Barclays U.S. Treasury U.S. TIPS Index, an unmanaged index that comprises inflation-protected securities issued by the U.S. Treasury. U.S. bonds are represented by the Bloomberg Barclays U.S. Aggregate Bond Index, which tracks the performance of U.S. investment-grade bonds in government, asset-backed, and corporate debt markets. Bloomberg was added to Barclays index names on 8/24/16. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

Diversification does not guarantee a profit or eliminate the risk of a loss.

MF414725