What are closed-end funds?

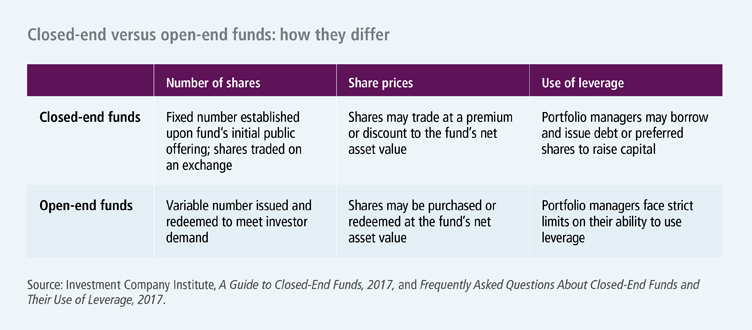

When investors think of mutual funds, closed-end funds rarely come to mind, even though they share plenty of similarities with open-end funds and exchange-traded funds (ETFs). Unlike their better-known siblings, closed-end funds offer a fixed number of shares rather than issuing new ones to meet potential investor demand. What’s more, closed-end fund shares typically trade at prices that are either lower or higher than the current market value of their portfolio holdings, rather than at prices that match current value.

These differences and others offer potential benefits that can make closed-end funds appealing to certain investors, depending on their objectives and risk tolerance.

Differences and similarities: closed- and open-end funds, and ETFs

All three types of funds operate under the Investment Company Act of 1940, the law that established the regulatory framework for today’s fund industry. The best-known and most abundant type in terms of assets and number of funds are open-end funds, so called because they issue and redeem shares in an open-ended fashion to meet investor demand.

With closed-end funds, professional money managers sell a fixed number of shares when the fund launches in an initial public offering. The shares are generally not redeemable, as the fund’s managers aren’t required to buy back shares from investors on demand. If additional investors want to buy shares beyond those originally issued, the fund’s managers typically don’t issue more. New clients typically purchase shares on an exchange, where buyers of the listed shares are matched with sellers.

As with stocks and ETFs that also trade on exchanges, prices rise or fall over the course of the trading day, rather than being priced only at the close of trading like mutual funds. A closed-end fund that’s in high demand may trade at a premium—a price that’s above the fund’s net asset value (NAV) reflecting the value of the fund’s cumulative portfolio holdings, less any liabilities—while one with little demand may trade at a discount below its NAV.

In contrast, investors in open-end funds buy or sell shares at the NAV, and managers must balance the fund’s cash flow and ensure adequate liquidity so shareholders can purchase or redeem daily. Depending on whether net flows into the fund are positive or negative, the managers buy or sell stocks, bonds, or other securities to align the fund’s invested assets with the current number of shareholders.

Closed-end funds present unique opportunities and risks

From the perspective of a closed-end fund’s managers, the closed structure creates a degree of stability, as money does not regularly flow into or out of the fund merely because investor demand for shares fluctuates. This can be advantageous because the portfolio manager is never forced to deploy new assets at potentially high prices or to sell holdings at potentially low prices to meet redemptions. While open-end fund managers typically maintain modest portfolio allocations to cash or other highly liquid assets to meet redemptions on demand, closed-end fund managers can keep portfolios fully invested in the market.

From an investor’s standpoint, the supply-and-demand dynamic that stems from maintaining a fixed number of shares means that a closed-end fund’s shares typically trade at a price that is above or below the fund’s NAV. If the price is below the NAV, shares can be purchased at a discount, a potential benefit for a buyer. If the price is above the NAV, purchases are made at a premium, potentially hurting the buyer.

That variable introduces an additional source of opportunity and risk for investors in closed-end funds, beyond potential capital returns that reflect changing asset prices as markets rise or fall. In addition, premiums and discounts for closed-end funds tend to widen when markets are volatile.

Other key differences between closed- and open-end funds

Market size—The closed-end market is a small piece of the overall mutual fund market. The category had 531 funds as of September 2017, totaling $274.6 billion in assets under management. Industrywide, there were about 8,000 mutual funds with total assets of nearly $18.1 trillion.1

Asset mix—Most closed-end funds invest primarily in bonds; in contrast, the mutual fund industry is predominately stock funds. About 60% of all closed-end fund assets were invested in fixed income as of September 2017, and a little more than half of that total was invested in municipal bonds.2

Income potential—While most closed-end funds invest primarily in bonds that can generate income from interest payments, many closed-end stock funds are dividend strategies that make distributions from the quarterly dividends that the portfolio’s stock holdings pay out. In 2016, closed-end funds made a total $16.2 billion in distributions from income from interest and dividends, realized capital gains, and return of capital.3

Leverage—Closed-end funds have the ability to use leverage, or borrowing, as part of their investment strategy, subject to regulatory restrictions. At year-end 2016, 64% of closed-end funds were using some form of leverage, such as bank debt, as part of their strategy.4 While the use of leverage can potentially allow a closed-end fund to achieve higher long-term returns, it also can increase risk and the likelihood of share price volatility.

Preferred shares—Closed-end funds are also permitted to employ leverage by issuing one class of preferred shares in addition to common shares, an allowance that does not extend to open-end funds. Unlike owners of common shares, preferred shareholders of closed-end funds are paid dividends but don’t share in the gains and losses of the fund. Issuing preferred shares allows a closed-end fund to raise additional capital, which the fund’s managers can use to purchase more securities for the portfolio.

Investor demographics—U.S. households that owned closed-end funds in 2016 tended to be wealthier than owners of mutual funds, with average household financial assets of $450,000, versus $200,000 for those owning mutual funds, according to an Investment Company Institute survey. Furthermore, closed-end fund owners tended to be older, with 35% retired from their lifetime occupations compared with 24% of those owning mutual funds. This makes sense, given the large percentage of closed-end funds investing in municipal bonds, which are often popular among wealthier, income-seeking investors. That said, closed-end fund owners tended to have a wide range of investments, as 92% reported also owning stock mutual funds, individual stocks, or variable annuities.5

Important disclosures

1 Investment Company Institute, Closed-End Fund Assets and Net Issuance, Third Quarter, 2017, and Trends in Mutual Fund Investing, September 2017.

2 Investment Company Institute, Closed-End Fund Assets and Net Issuance, Third Quarter, 2017.

3, 4, 5 Investment Company Institute, 2017 Investment Company Factbook.

Past performance does not guarantee future results.

As is the case with all closed-end funds, shares of this fund may trade at a discount to the fund’s net asset value (NAV). An investment in the fund is subject to investment and market risks, including the possible loss of the entire principal invested. There is no guarantee prior distribution levels will be maintained, and distributions may include a substantial return of capital, which may increase the potential gain or reduce the potential loss of a subsequent sale. Fixed-income investments are subject to interest-rate risk; their value will normally decline as interest rates rise. An issuer of securities held by the fund may default, have its credit rating downgraded, or otherwise perform poorly, which may affect fund performance. The fund’s use of leverage creates additional risks, including greater volatility of the fund’s NAV, market price, and returns. There is no assurance that the fund’s leverage strategy will be successful.

Focusing on a particular industry or sector may increase the fund’s volatility and make it more susceptible to market, economic, and regulatory risks, as well as other factors affecting those industries or sectors.

MF421500