Navigating the new normal: fixed-income investing in a world of mounting risks

In today's fixed-income environment, where anemic yields have become the norm, investors everywhere are facing similar challenges.

Whether seeking incremental returns, helping to protect against rising interest rates, or diversifying away from domestic bond markets, investors are struggling with how to best design their fixed-income portfolios to achieve their financial goals. Traditional domestic fixed-income strategies have historically delivered competitive returns with lower volatility, but given their current low yields, higher duration characteristics, and the upward pressure on shorter-term interest rates, it's unlikely those strategies will deliver the same risk/reward profile going forward.

One obvious option available to investors is to significantly reduce their fixed-income exposure. However, by abandoning bonds and moving to other asset classes for the sake of generating returns, investors are courting higher volatility and a possible loss of capital—hardly an attractive trade-off.

Another flawed option is to simply alter the mix of securities held in a portfolio. Increased static allocations to high-yield bonds, floating-rate debt, or emerging-market debt, for example—some of the higher-yielding options available in today's market—undermine one of the key benefits fixed income brings to a portfolio: the asset class's ability to dampen overall volatility, especially risk stemming from equity exposure. Meanwhile, those segments of the bond markets with the lowest correlations to equities—short-term credit and mortgage-backed securities—have high correlations to the interest-rate-driven Bloomberg Barclays U.S. Aggregate Bond Index. Ultimately, there are no free lunches when it comes to sector allocation within a fixed-income portfolio. The third option—and we believe the best—is for investors to dedicate a portion of their fixed-income assets to strategies with broader guidelines and increased manager discretion, a focus on overall volatility rather than risk versus a stated benchmark, and exposure to nontraditional sectors that may offer greater diversification, yield, and total return opportunities.

Currency is key to unlocking the diversification benefits of global fixed income

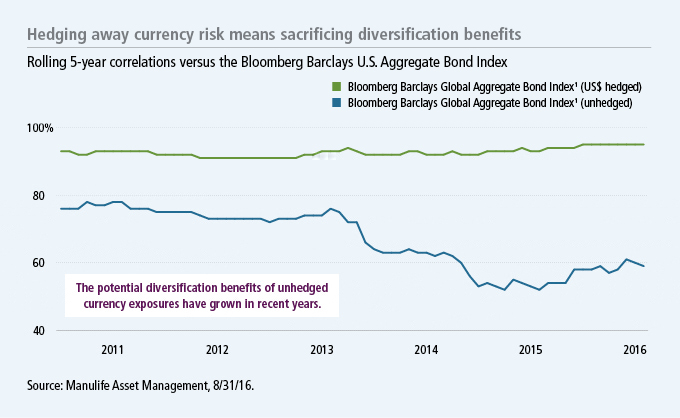

By allocating to strategies with broader opportunity sets, investors are able to immediately gain exposure to a wider range of geographic regions, countries, sectors, currencies, and credit qualities while also adding a layer of diversification away from domestic interest-rate risk. But here, there's an often underappreciated caveat: The diversification benefits of a global opportunity set are directly tied to the underlying currency exposures; hedging away all currency risk virtually eliminates the diversification benefit of a global allocation. Unhedged positions, on the other hand, have shown much lower—and falling—correlations to the U.S. bond market over the past five years.

While a fully unhedged mandate provides a diversification benefit, completely embracing currency risk exposes investors to the high volatility of local currency markets, which have historically been the primary driver of performance in a global bond portfolio. The sweet spot for investors, we believe, lies in actively managing currency exposure, embracing currency risk among strengthening foreign currencies, and mitigating it among those that are weakening. This approach can still provide the diversification benefits of an unhedged global portfolio, but with a potentially lower volatility profile.

Rising U.S. interest rates underscore the need for broader horizons

In today's fixed-income landscape, defined by extraordinarily low yields, conventional high-quality bond strategies are no longer sufficient to meet investors' return objectives. Such high-quality fixed-income assets will continue to offer investment benefits such as potentially adding diversification to an equity-oriented portfolio, dampening total portfolio volatility, and providing liquidity in stressed markets.

We believe a more calculated approach is necessary within a fixed-income allocation. Rather than ride the highs and lows of a static benchmark allocation, global multi-sector strategies can seek out the best parts of the market and, just as important, help avoid those parts of the market that present the most risk altogether. By actively navigating the opportunities in the currency markets, a portfolio with a global scope may add significant diversification away from domestic, rate-driven risks—a key feature for any bond allocation in today's rising-rate environment.

1 The Bloomberg Barclays Global Aggregate Bond Index tracks the performance of global investment-grade debt in fixed-rate treasury, government-related, corporate, and securitized bond markets. Hedged returns for the index do not reflect the effects of currency fluctuations on foreign-denominated securities. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Important disclosures

Diversification does not guarantee a profit or eliminate the risk of a loss.

Foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. Fixed-income investments are subject to interest-rate and credit risk; their value will normally decline as interest rates rise or if an issuer is unable or unwilling to make principal or interest payments. Liquidity—the extent to which a security may be sold or a derivative position closed without negatively affecting its market value, if at all—may be impaired by reduced trading volume, heightened volatility, rising interest rates, and other market conditions. Investments in higher-yielding, lower-rated securities include a higher risk of default. Mortgage- and asset-backed securities may be sensitive to changes in interest rates and may be subject to early repayment and the market's perception of issuer creditworthiness. The use of hedging and derivatives could produce disproportionate gains or losses and may increase costs. Hedging and other strategic transactions may increase volatility and result in losses if not successful.

MF315381