Where strategic beta ETFs have outpaced active funds

Most discussions in the active/passive debate reflect a binary view of investment performance: While active management affords the opportunity to beat a benchmark, many active strategies underperform depending on the investment category and timeframe under examination. In contrast, passive approaches by definition generate returns that modestly trail their benchmarks net of fees. However, relatively low expenses provide a cost advantage that's helped them outperform many active strategies recently.

The growth of strategic beta in recent years represents an attempt to find an attractive alternative to active and passive investing—one that offers inexpensive, diversified equity exposure with market-beating potential. Rather than tracking traditional market-capitalization-weighted indexes, strategic beta strategies track custom-designed indexes weighted in favor of certain characteristics, such as value, momentum, or size. Today, a growing number of advisors employ strategic beta within the exchange-traded fund (ETF) portion of client portfolios, and the nearly $500 billion in strategic beta ETF assets now represents roughly 21% of the overall ETF market.1

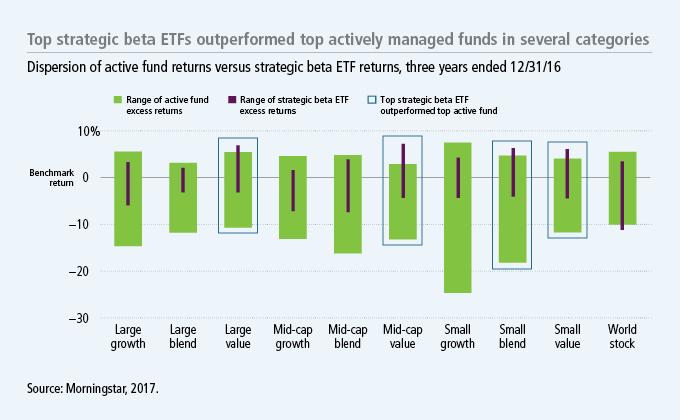

Strategic beta ETFs have outperformed in certain categories

We looked at the performance of active strategies and strategic beta ETFs across several equity categories for the three-year period ended December 31, 2016. We found that the top-performing strategic beta ETF outperformed common benchmarks and all actively managed strategies in four of the ten categories, based on annualized total returns net of fees: large value, mid-cap value, small blend, and small value. By comparison, the top-performing actively managed fund outpaced all strategic beta ETFs in six of the ten categories: large growth, large blend, mid-cap growth, mid-cap blend, small growth, and world stock. However, even in categories in which active funds provided the top returns, many strategic beta ETFs outperformed the common benchmarks.2

A narrower range of outcomes than actively managed funds

Another notable finding is that the dispersion of returns among strategic beta ETFs was significantly narrower than that of active funds; that is, returns of the strategic beta ETFs were typically bunched together more closely than the more wide-ranging results of the active funds. In all but one category, the bottom-performing strategic ETF delivered a result above that of the bottom-performing actively managed fund, although both underperformed the common benchmark index. The strategic beta ETF returns in most cases skewed toward better performance than actively managed funds, suggesting that it may be easier to outperform the index by choosing a strategic beta approach than by trying to find the right active manager.

These findings suggest that strategic beta ETFs, when employed selectively, can offer investors the opportunity to generate market-beating returns, and, in some instances, the opportunity to outperform to a higher degree than actively managed funds in a given equity investment category.

Passive and active flows show investors can be savvy

Our analysis of the flow of assets into the passive strategies and actively managed funds was also revealing. Net flows to actively managed funds were negative during the three-year period in equity categories in which the range of active returns skewed heavily toward underperformance relative to respective Russell benchmarks. In contrast, net flows in those same categories were generally positive for passive strategies, including strategic beta ETFs. This suggests that investors, in aggregate, are aware of the potential performance differences among strategies and are directing their investment dollars accordingly.

1 “The Number of Strategic-Beta ETPs Continues to Mushroom,” Morningstar, Inc., September 2016. 2 Many funds within large value and other categories use different benchmarks than the Russell indexes that were used in this study as common benchmarks for funds within their respective categories.

Important disclosures

Important disclosures

Universe of fund returns is compared against benchmarks in the following categories: large growth, Russell 1000 Growth Index; large blend, Russell 1000 Index; large value, Russell 1000 Value Index; mid growth, Russell Midcap Growth Index; mid blend, Russell Midcap Index; mid value, Russell Midcap Value Index; small growth, Russell 2000 Growth Index; small blend, Russell 2000 Index; small value, Russell 2000 Value Index; and world stock, MSCI World Index. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Diversification does not guarantee a profit or eliminate the risk of a loss.

Investing involves risks, including the potential loss of principal. There is no guarantee that a fund's investment strategy will be successful. John Hancock Multifactor ETF shares are bought and sold at market price (not NAV), and are not individually redeemed from the fund. Brokerage commissions will reduce returns.

John Hancock ETFs are distributed by Foreside Fund Services, LLC, and are subadvised by Dimensional Fund Advisors LP. Foreside is not affiliated with John Hancock Funds, LLC or Dimensional Fund Advisors LP.

MF358403 JHAN-2017-03-16-0552