Where advisors are finding value and performance with ETFs

The explosive growth of ETFs in recent years has offered financial professionals new tools for gaining precise asset class exposure while also managing overall portfolio cost.

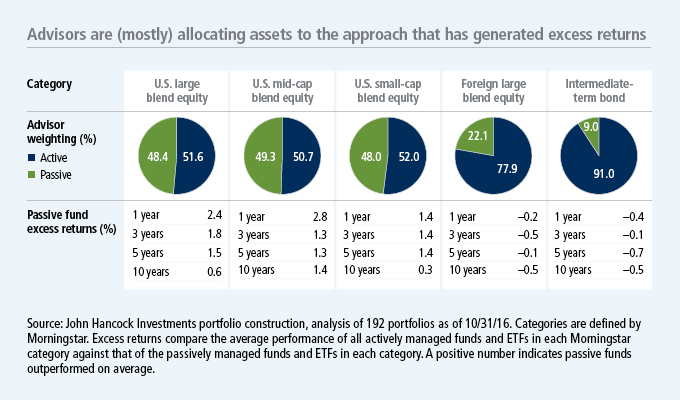

Of course, investment performance is a key consideration, and an analysis of advisor model portfolios by John Hancock Investment Management found that advisors are indeed being selective in how they incorporate exchange-traded funds (ETFs) into client portfolios, paying close attention to where passive strategies have historically had a performance edge over active managers. The research analyzed 192 model portfolios constructed by financial planners, broker-dealers, and other intermediaries who do business with John Hancock Investment Management.

Most advisors blend ETFs with active

Despite the growth of ETFs, ETF purists remain rare. A majority (56%) of the 192 advisors in our study use ETFs in client portfolios, but no advisors use them exclusively. What's more, 93% of these advisors allocated less than 50% of a typical client portfolio to ETFs, with the remaining assets distributed among index funds, actively managed funds, and individual securities.

Performance matters

Striking a balance between performance and cost has taken on new significance in light of the U.S. Department of Labor's Fiduciary Rule, which codifies the idea that advisor recommendations inside of qualified retirement accounts must be in the best interests of their clients. Clearly, investment performance is harder to manage on a go-forward basis than cost, yet advisors appear to be taking performance into consideration when incorporating ETFs into client portfolios.

The study looked at the asset mixes of five key Morningstar categories within advisor model portfolios: U.S. large blend equity, U.S. mid-cap blend equity, U.S. small-cap blend equity, foreign large blend equity, and intermediate-term bond. In categories in which passive strategies have had a slight performance advantage over time, advisors are roughly splitting their client allocations between active and passive, possibly choosing to retain a measure of active risk management while lowering overall cost. In categories in which active strategies have historically outperformed—foreign large blend and intermediate-term bond, for example—advisors are recommending a much smaller allocation to passive strategies, thereby giving more weight to performance considerations.

Strategic beta is growing

One noticeable shift taking place within the ETF portion of advisor portfolios is the growth of strategic beta strategies. The first U.S. strategic beta ETFs launched in May 2000. Since then, the number has grown to more than 600 strategies and nearly $500 billion in assets, representing roughly 21% of the overall ETF market today.1 The appeal is understandable: By focusing on a particular factor or set of factors, strategic beta ETFs seek to outperform broad-based indexes over time without incurring the trading costs traditionally associated with active management. Strategic beta practitioners such as Dimensional Fund Advisors refer to this as “adding a little bit of judgment” to an otherwise overly mechanical process.

Among the advisor portfolios we analyzed, just 6% used strategic beta strategies exclusively in their passive allocations, compared with 26% who used traditional capitalization-weighted strategies exclusively. The majority (69%) used a combination of cap-weighted and strategic beta.

Conclusions expressed in this article are based on the data collected in the John Hancock Investment Management study and may not be representative of all financial professionals.

1 “The Number of Strategic BETA ETPs Continues to Mushroom,” Morningstar, September 2016.

Important disclosures

Important disclosures

Diversification does not guarantee a profit or eliminate the risk of a loss.

Investing involves risks, including the potential loss of principal. There is no guarantee that a fund's investment strategy will be successful. John Hancock Multifactor ETF shares are bought and sold at market price (not NAV), and are not individually redeemed from the fund. Brokerage commissions will reduce returns.

John Hancock ETFs are distributed by Foreside Fund Services, LLC, and are subadvised by Dimensional Fund Advisors LP. Foreside is not affiliated with John Hancock Funds, LLC or Dimensional Fund Advisors LP.

MF338554 JHAN-2016-12-16-0482