ESG research the new cornerstone of emerging market investing

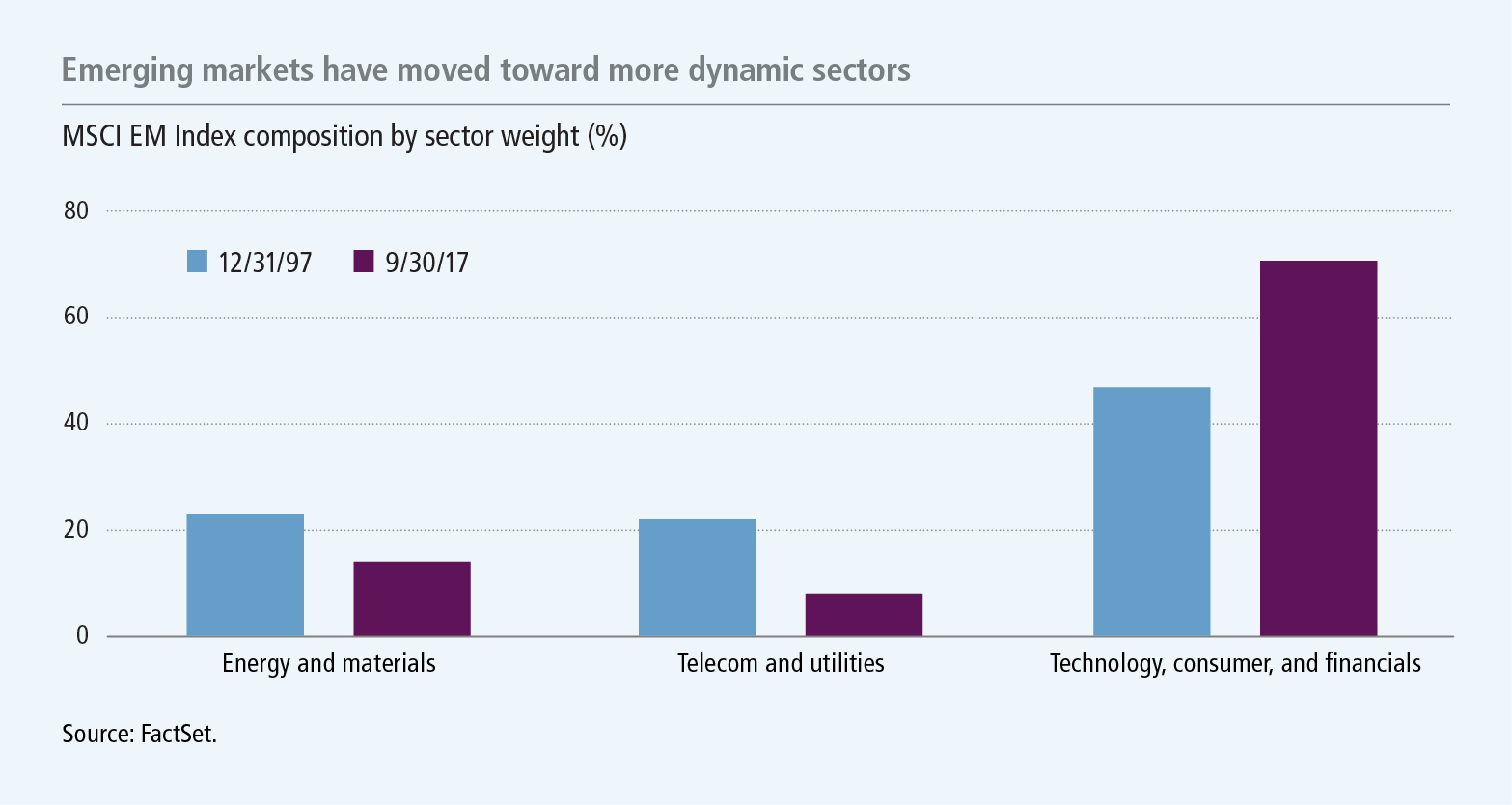

Today, it's widely recognized that the emerging markets have become a major driver of the global economy. Now home to a diversified mix of sectors and industries, different emerging markets are increasingly better supported by robust service sectors and a growing middle class. This complex socioeconomic evolution is helping to drive innovation, new sources of profit, and a more diverse profile of business growth.

With respect to environmental, social, and governance (ESG) factors, many investors believe these represent risks that remain higher in emerging markets (EMs) than in developed markets. But at Boston Common Asset Management, we observe that ESG issues are now being taken far more seriously by companies, exchanges, and regulators across the EMs, and that data on ESG dimensions has become substantially more robust than in the past. In today’s context, the contribution of ESG research and analysis has expanded beyond identifying potential areas of risk to a growing source of investment opportunity. Accordingly, going forward, we think that EM-focused strategies that fully integrate ESG considerations into their investment process stand to benefit disproportionately relative to those that don't.

Rapid growth propels ESG adoption

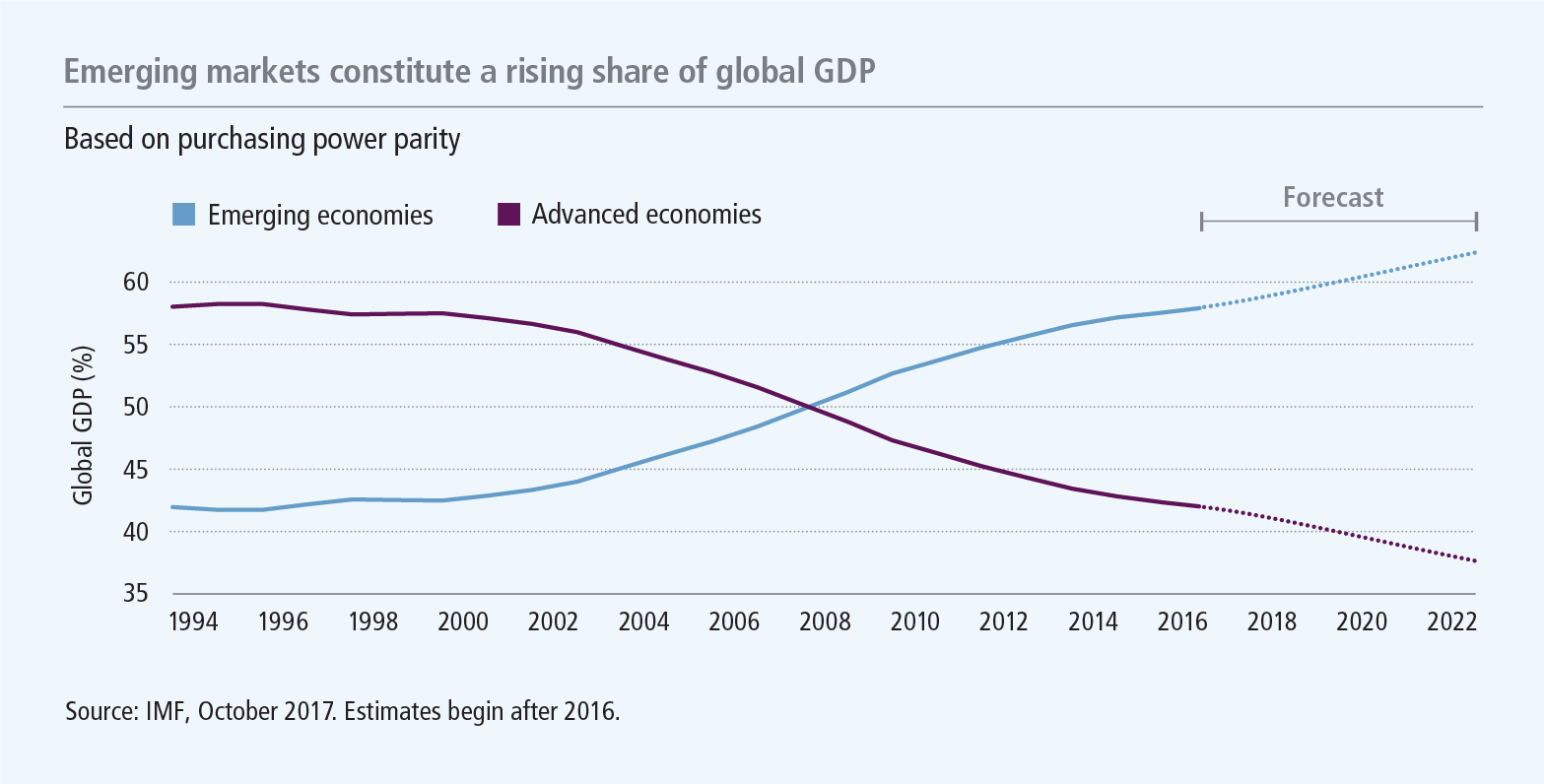

EMs are no longer solely dependent on commodity export growth, unlike two decades ago. Fueled by diversifying economies and expanding middle classes, EM countries now contribute more than half of global GDP and are growing faster than developed markets. Rapid growth and rising economic aspirations have made sustainable resource management a more critical concern for businesses and governments alike.

In our research, we've found that the most dynamic growth areas in today’s emerging markets also happen to be in sectors in which better ESG practices can contribute directly to superior business results. For example, more sustainable forms of human capital management can be a key differentiator in sectors and industries such as financials, software, and tourism, where talent retention and employee motivation can help firms create a competitive advantage. Significantly, newly minted middle classes are paying more attention to ESG issues. As a result, many leading EM companies are actively seeking to adopt ESG best practices to enhance their standing relative to peers.

Companies with strong ESG practices may ultimately deliver better returns on invested capital. Simply put, we think companies with forward-thinking governance culture—and management focused on long-term growth and innovation fostered through sustainable relationships with all stakeholders—are better aligned with shareholder value.

ESG analysis is becoming indispensable for active investors, especially in emerging markets

The quality and breadth of ESG data on EM companies are still developing. As sources of ESG information evolve, assessments of ESG concerns are becoming ever more valuable components of investment insight.

In our view, ESG analysis provides investors with additional, independently derived insight into a company’s management quality, strategic positioning, operational efficiency, and potential risk exposures. As an asset class, EM equities are generally understood to be less efficient than developed-market stocks and to carry higher levels of risk. Active investors can look to ESG-related analysis, staked on more robust information sources, to produce risk-mitigating insight.

In this regard, we believe corporate governance is one of the most critical areas to pay close attention to in EM investing, given that poor governance practices can have significant costs. In contrast, strong corporate governance can signal greater transparency and more robust management, and it often coexists with better environmental and social practices. Unsurprisingly, industry surveys have found that EM investors are willing to pay a premium for better corporate governance, creating a lower cost of capital for governance leaders.1 ESG research is distinctly positioned to help uncover companies with strong governance standards, which in turn can help reduce investment risk.

Identifying opportunity in sustainable solutions

While risk mitigation has traditionally been a primary consideration for incorporating ESG factors into investment analysis, ESG research today can be understood as an engine for locating compelling investment opportunity. EM economies and companies are gaining strength against a backdrop of climate change, resource pressure and scarcity, and new technological opportunities. This makes it imperative for EM companies to find innovative solutions to pressing environmental or social problems, gain scale in their home markets, and become leading suppliers to other EM as well as developed-market economies. Investors who are keenly attuned to ESG issues can identify these leading innovators that can capitalize on the early-mover advantages in new end markets.

For example, in China, environmental degradation and air pollution have resulted in enormous social pressure on the government to curb harmful emissions. This is helping to create exciting opportunities to invest in companies leading the charge against air pollution, finding new ways to deliver clean water, and actively developing cleaner-burning energy sources, such as natural gas, as well as technologies for building affordable electric vehicles. In all these areas, a variety of companies provide solutions to pressing environmental needs and offer potentially attractive returns.

Financial services offer another example of a growing sector in which local companies can carve out a niche strategy in underserved markets that offer attractive returns while also promoting economic mobility. For example, select southeast Asian banks that provide commercial microloans to small and midsize firms make for an exciting target market with dynamic growth and impact potential.

Three degrees of ESG: company, exchange, investor

The number of EM companies reporting on sustainability is rapidly increasing, but the adoption of better ESG practices hasn't been limited to individual companies and industries. Stock exchanges have also come to recognize potential advantages to supporting ESG disclosure by listed companies. Exchanges in Brazil and South Africa were among the first EM stock exchanges to adopt ESG disclosure requirements and launch ESG indexes. In the past three years, six Asian countries—Hong Kong, India, Malaysia, Singapore, South Korea, and Taiwan—have adopted investor stewardship codes. Strong support from leading EM companies has also helped motivate governments to move toward better disclosure requirements. The Global Reporting Initiative database indicates that sustainability reporting has steadily increased across key EM countries. For example, the number of sustainability reports produced by Chinese companies doubled between 2014 to 2016.

Working with and through the UN-backed Principles of Responsible Investment (PRI) and the Asian Corporate Governance Association, Boston Common has encouraged stock exchanges to support more relevant ESG disclosure from companies. Through one unique collaboration, we asked 73 global bourses to issue voluntary guidance on reporting ESG information by the end of 2016. Through another, we provided feedback to the Taiwan Stock Exchange on the stewardship principles of institutional investors in 2015.

Notably, major investors from EMs are also beginning to focus on ESG factors. Following the early participation of Brazilian and South African funds, China’s largest institutional investor, China Asset Management Company, which as of December 2016 had $173 billion in assets under management, became the country’s first signatory to the UN-supported PRI in 2017.

The road ahead for ESG investing

Many EMs have become more complex and economically diversified in recent decades, and they no longer rely solely on volatile commodity markets to drive growth. The path to sustainable economic expansion is being sought in the balanced development of strong domestic growth to complement global trade. Consequently, innovative EM-based companies are focusing on more than external end markets, acknowledging the needs of EM consumers and taking their growing awareness of and interest in sustainable ESG business practices seriously.

Companies and regulatory agencies in EMs continue to make steady progress in improving the quality and breadth of ESG disclosure and practice. Global investors who look to ESG assessments for superior risk management are finding that these same strategies also offer the potential for adding to returns across a variety of countries and sectors. Indeed, the pattern and trajectory of EM growth have made a deep understanding of and active engagement with ESG issues indispensable for investors who want to participate in what may be the most lasting promise of emerging markets.

1 “Survey Says …: Corporate Governance Matters to Investors in Emerging Market Companies,” International Finance Corporation, 2010. The MSCI Emerging Markets (EM) Index tracks the performance of publicly traded large- and mid-cap emerging-market stocks. It is not possible to invest directly in an index.

Important disclosures

Diversification does not guarantee a profit or eliminate the risk of a loss.

Foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. Large company stocks could fall out of favor. The stock prices of small and midsize companies can change more frequently and dramatically than those of large companies. A fund’s ESG policy could cause it to perform differently than similar funds that do not have such a policy. Currency transactions are affected by fluctuations in exchange rates.

MF411521