Hedging inflation and interest-rate risk with enduring assets

After lying largely dormant for the last decade, inflation and interest rates have risen and returned to the investment conversation.

But many portfolios emphasizing mainstream stocks and bonds remain vulnerable to inflation and interest-rate surprises. Fortunately, certain alternative investments, such as listed global infrastructure and publicly traded companies holding other enduring assets, have characteristics that may help investors manage inflation and interest-rate risk.

Enduring assets are physical assets whose economic lives are typically measured in decades. The opportunity set includes electric, gas, and water networks; power-generation plants; and oil and gas pipelines, which can also extend to transportation infrastructure such as highways, railroads, port facilities, and even telecommunications infrastructure. While the equity of companies in these industries may not be as exciting as more cyclical sectors, such as technology or consumer discretionary, enduring assets offer several benefits that we view as more valuable over time, including the potential to hedge inflation and interest-rate rises and a more attractive risk/reward profile. We view the risk/reward ratio of enduring assets favorably because government regulations or long-term contracts tend to protect returns on investment for companies in these industries.

“While the equity of companies in these industries may not be as exciting as more cyclical sectors, such as technology or consumer discretionary, enduring assets offer several benefits that we view as more valuable over time …”

Regulated returns and long-term contracts reduce inflation and interest-rate risks

These regulations or long-term contracts lead to one of the most attractive attributes of enduring assets—many of the businesses operate on a cost-plus model, which allows higher interest rates or inflation costs to be passed to end consumers. Unlike many industries, where interest rates are costs that erode corporate profits, companies holding enduring assets often pass higher interest rates or higher rates of inflation directly to customers. For investors in these types of securities, the return on equity is a spread over the prevailing interest or inflation rate. Increases in inflation or interest rates lead to higher allowed returns for the company—and therefore higher earnings per share for the stock.

Cost-plus business models and regulated assets: an example

As an example, it’s helpful to take a closer look at regulated assets, where transparency is greatest, but where the same principles also apply to contracted assets. Regulated assets in most developed markets are currently allowed to earn nominal equity returns ranging from 8% to 12%, with an average of about 10%, and real returns ranging from 5% to 7%, with an average of about 6%.1 In North America, returns are typically set in nominal terms, not adjusted for inflation.

However, in Europe, returns are typically set in real, or inflation-adjusted, terms, which insulates a company’s returns from an erosion of its purchasing power. Similar to the distinguishing feature of an inflation-linked bond, the regulated asset base automatically adjusts each year by an amount depending on the prevailing rate of inflation in the local market, thereby providing inflation protection.

Regulated returns in emerging markets are even more attractive, running roughly 2% to 4% higher than those in developed markets.1 Some markets, including many in Latin America, provide inflation protection, while others, including many in Northern Asia, provide returns tied to nominal interest rates. In an environment of rising inflation, exposure to inflation-linked assets are typically preferable to their nominal return counterparts. We adjust the weightings of different asset types depending on the market environment to take advantage of the differences in expected returns.

Risks of inflation surprises have increased

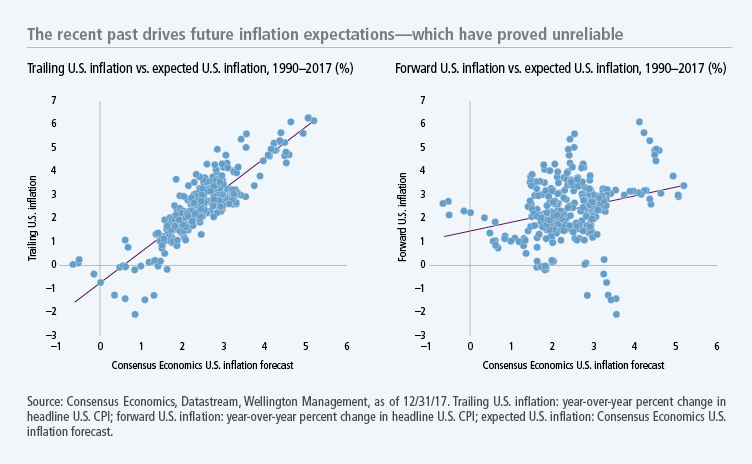

Having exposure to companies and assets with the ability to pass along inflation costs is more important now than at any other time in the last decade. Given today’s tight labor markets, the narrowing output gap, stronger global demand, U.S. fiscal stimulus, and loose monetary policy in much of the rest of the world, we could see a sustained period of higher inflation—which the markets haven’t grappled with since the 2008 global financial crisis. Unfortunately, the forward inflation expectations of market participants are closely tied to trailing inflation rates, and history shows that the realized rate of inflation has been difficult to anticipate. Changing inflation rates have been rife with surprises, and investors and economists alike have often seen their expectations proved unreliable.

“Having exposure to companies and assets with the ability to pass along inflation costs is more important now than at any other time in the last decade.”

Enduring assets have remained resilient to interest-rate risk

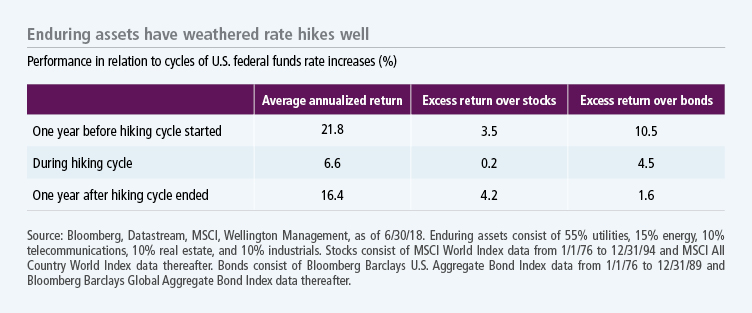

One of the chief concerns about enduring assets is their perceived sensitivity to interest rates. While there can be some short-term impact on equity prices during periods of rising interest rates—particularly sharp, unanticipated increases—historical data shows that enduring assets have rebounded. In examining the cycles of U.S. federal funds rate increases since 1976, enduring assets have historically outperformed the global equity market, both immediately before and after the rate-hiking cycle, and they’ve performed in line with the market throughout a full business cycle, on average. Over the same period, enduring assets have, on average, also outperformed bonds—before, during, and after the rate-hiking cycle.

In addition to diversifying the typical investor’s home country bias, the geographic dispersion of the world’s enduring assets helps boosts their effectiveness as not only U.S.—but also global—inflation hedges. After an extended period of negligible inflation, even negative interest rates in certain developed economies, pressures that have historically driven rate rises, appear to be mounting more quickly. Now may be the time to take a closer look at enduring assets—representing an overlooked and underappreciated area of the market that may help you manage inflation and interest-rate risk in the months and years ahead.

1 Wellington Management, 2018.

Important disclosures

Important disclosures

The MSCI World Index tracks the performance of publicly traded large- and mid-cap stocks of developed-market companies. The MSCI All Country World Index (ACWI) tracks the performance of publicly traded large- and mid-cap stocks of companies in developed markets and emerging markets. The Bloomberg Barclays U.S. Aggregate Bond Index tracks the performance of U.S. investment-grade bonds in government, asset-backed, and corporate debt markets. The Bloomberg Barclays Global Aggregate Bond Index tracks the performance of global investment-grade debt in fixed-rate treasury, government-related, corporate, and securitized bond markets. It is not possible to invest directly in an index.

While the fund is not managed to track a benchmark, its multiple strategies and focus on investments in certain sectors may lead it to lag broad market rallies. The fund is non-diversified and holds a limited number of securities, making it vulnerable to events affecting a single issuer. Master limited partnerships and other energy companies are susceptible to changes in energy and commodity prices. Natural resource investments are subject to political and regulatory developments and the uncertainty of exploration. The stock prices of midsize and small companies can change more frequently and dramatically than those of large companies. Fixed-income investments are subject to interest-rate and credit risk; their value will normally decline as interest rates rise or if an issuer is unable or unwilling to make principal or interest payments. Investments in higher-yielding, lower-rated securities include a higher risk of default. Foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. The use of hedging and derivatives could produce disproportionate gains or losses and may increase costs. Liquidity—the extent to which a security may be sold or a derivative position closed without negatively affecting its market value, if at all—may be impaired by reduced trading volume, heightened volatility, rising interest rates, and other market conditions. REITs may decline in value, just like direct ownership of real estate.

MF593412