Asset allocation funds are designed to help:

- Provide broad exposure to financial markets

- Provide diversification potential through a mix of asset classes, investment styles, and asset managers

Asset allocation portfolios are a great way to get diversified exposure to financial markets in a single step. Our multimanager asset allocation portfolios bring together some of the best specialized investment teams from around the world.

Why diversify? Because markets are unpredictable test

Different types of investments react differently to market forces. As a result, today's asset class leader may be tomorrow's laggard. A diversified investment approach that includes a range of asset classes can help you pursue your long-term financial goals while managing the risks along the way.

There's no telling which asset class will be the best performing from year to year

Annual returns of asset class categories

Important Disclosures

Source: Morningstar, as of 12/31/20. Investment-grade bonds are represented by the Bloomberg Barclays U.S. Aggregate Bond Index, which tracks the performance of U.S. investment-grade bonds in government, asset-backed, and corporate debt markets. High-yield bonds are represented by the Intercontinental Exchange (ICE) Bank of America (BofA) U.S. High Yield Master II Index, which tracks the performance of globally issued, U.S. dollar-denominated high-yield bonds. Cash is represented by the FTSE 3-Month U.S. Treasury Bill Index, which is a market-value-weighted index that tracks the performance of three-month U.S. Treasury debt. International equity is represented by the MSCI All Country (AC) World ex-USA Index, which tracks the performance of publicly traded large- and mid-cap stocks of companies in developed and emerging markets outside the United States. U.S. small-cap equity is represented by the Russell 2000 Index, which tracks the performance of 2,000 publicly traded small-cap companies in the United States. U.S. large-cap equity is represented by the Russell 1000 Index, which tracks the performance of 1,000 publicly traded large-cap companies in the United States. Alternatives are represented by an equally weighted combination of the HFRI Macro Index, the HFRI Equity Market Neutral Index, the HFRI Merger Arbitrage Index, the Morningstar real estate fund category average, the Morningstar emerging markets bond fund category average, and the Morningstar Long-Only Commodity Index. Diversified portfolio is represented by the average return of the six asset classes in the chart above, rebalanced monthly, excluding cash. It does not represent any specific index. Annual returns are based on calendar years. Indexes are unmanaged and do not take transaction costs or fees into consideration. It is not possible to invest directly in an index. Performance figures assume reinvestment of dividends and capital gains. This chart is for illustrative purposes only and does not represent the performance of any John Hancock fund. Past performance does not guarantee future results.

A deeper level of diversification from a leader in multi-asset investing

- We believe diversification should extend beyond asset classes to include multiple investment styles and multiple managers.

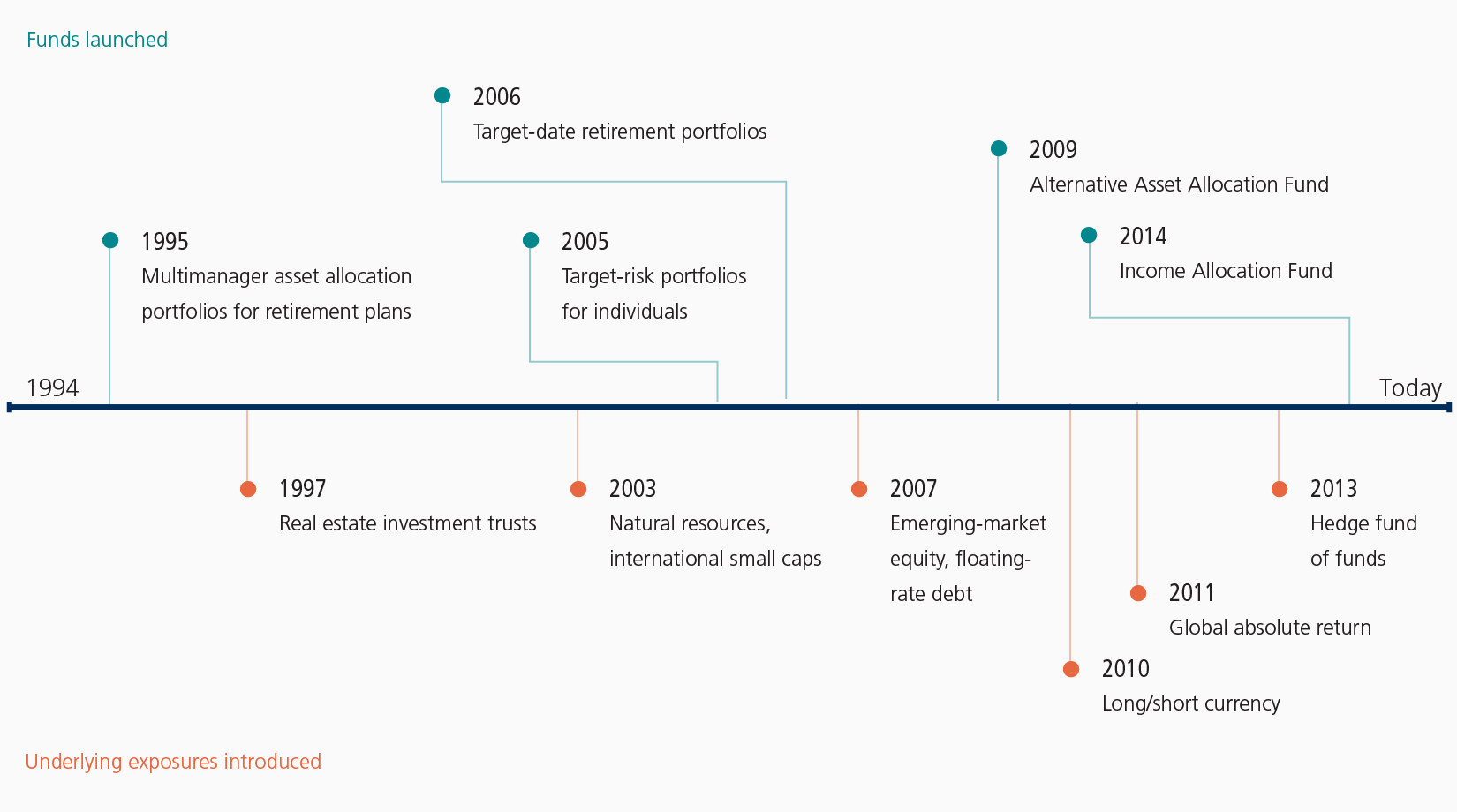

- Our expertise in multi-asset investing dates back to 1995, with our first suite of portfolios employing multiple asset managers.

- Since then, we've been at the forefront of portfolio design, introducing a wide array of new and alternative strategies into our asset allocation portfolios to strengthen their diversification benefits for individual and institutional investors.

Diversification does not guarantee a profit or eliminate the risk of a loss.

At John Hancock Investment Management, our history of asset allocation leadership and innovation spans over two decades

Today

Our asset allocation franchise represents more than a third of the $149 billion in client assets under management.

- Asset allocation

- U.S. equity

- Fixed income

- International equity

- Alternative

- Other

Important Disclosures

Source: John Hancock Investment Management, as of 12/31/20.

- Fund oversight—John Hancock Investment Management’s open-architecture approach oversees the complete selection and allocation process. To supplement our investment expertise, we scour the world for managers for different portfolio components and then adjust those components over time based on risk, expected returns, correlation, and manager performance.

- Multiple asset classes—Our managers allocate to various asset classes but can add new ones based on expected returns and portfolio fit. Our analysis seeks attractive multi-year expected returns and opportunities from market dislocations.

- Multiple managers—Our open-architecture approach identifies management teams specializing in distinct asset classes and styles, based on a proven record, experienced team, and repeatable process. We then monitor those teams to ensure they adhere to their mandates.

- Distinct styles—We adjust style blends to modify risk over time while seeking to enhance returns, preserve capital, and manage longevity exposure.

Finding the best specialized manager for every underlying allocation

John Hancock asset allocation portfolios—including our target-risk and target-date funds—harness the expertise of some of the best investment managers in the business, each with a distinct philosophy and approach.

Lifestyle Portfolios

Our Lifestyle Portfolios offer diversification—by asset class, investment style, and manager—across five risk/reward profiles, each of which remains steady over time

Asset allocation funds

Our asset allocation funds provide solutions ranging from core diversification to consistent income distribution

Lifetime Portfolios

Our Lifetime Portfolios are one-stop retirement investments, with a focus on low-cost implementation and income and capital appreciation when you need it most

- John Hancock Multimanager 2065 Lifetime Portfolio

- John Hancock Multimanager 2060 Lifetime Portfolio

- John Hancock Multimanager 2055 Lifetime Portfolio

- John Hancock Multimanager 2050 Lifetime Portfolio

- John Hancock Multimanager 2045 Lifetime Portfolio

- John Hancock Multimanager 2040 Lifetime Portfolio

- John Hancock Multimanager 2035 Lifetime Portfolio

- John Hancock Multimanager 2030 Lifetime Portfolio

- John Hancock Multimanager 2025 Lifetime Portfolio

- John Hancock Multimanager 2020 Lifetime Portfolio

- John Hancock Multimanager 2015 Lifetime Portfolio

- John Hancock Multimanager 2010 Lifetime Portfolio

Learn more

Financial advisors: See how our multimanager approach to asset allocation can help bring a deeper level of diversification to your clients' portfolios.

Request a meeting with a John Hancock Investment Management Business Consultant

* indicates a required field

Thank you

Your submission was successful

The portfolio’s performance depends on the advisor’s skill in determining asset class allocations, the mix of underlying funds, and the performance of those underlying funds. The portfolio is subject to the same risks as the underlying funds and exchange-traded funds in which it invests: Stocks and bonds can decline due to adverse issuer, market, regulatory, or economic developments; foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability; the securities of small companies are subject to higher volatility than those of larger, more established companies; and high-yield bonds are subject to additional risks, such as increased risk of default. Liquidity—the extent to which a security may be sold or a derivative position closed without negatively affecting its market value, if at all—may be impaired by reduced trading volume, heightened volatility, rising interest rates, and other market conditions. Please see the portfolios’ prospectuses for additional risks. This material is not intended to be, nor shall it be interpreted or construed as, a recommendation or providing advice, impartial or otherwise. John Hancock Investment Management and its representatives and affiliates may receive compensation derived from the sale of and/or from any investment made in its products and services.